The GAAP (Generally Accepted Accounting Principles) formula for determining a business’s profit is Sales – Expenses = Profit. It is simple, logical and clear. Unfortunately, it’s a lie.

The formula, while logically accurate, does not account for human behavior. In the GAAP formula profit is a left over, a final consideration, something that is hopefully a nice surprise at the end of the year. Alas, the profit is rarely there and the business continues on its check to check survival.

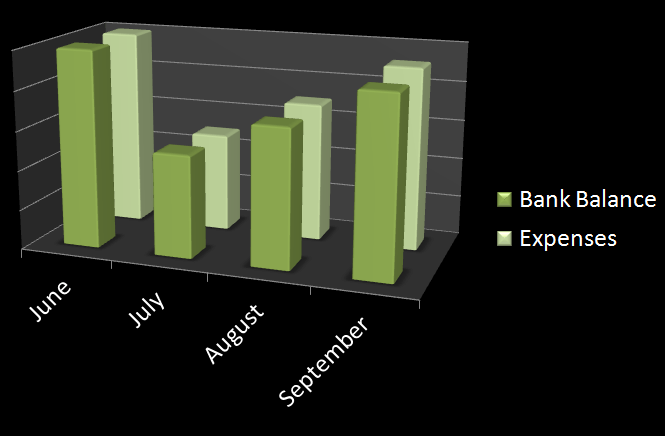

With Profit First you to flip the formula to Sales – Profit = Expenses. Logically the math is the same, but from the stand point of the entrepreneur’s behavior it is radically different. With Profit First, you take a predetermined percentage of profit from every sale first, and only the remainder is available for expenses.